This strategy is a trend-following trading strategy tailored for BTC/USDT pairs on the 1-hour timeframe. It focuses on identifying and riding significant market trends, minimizing risk, and maximizing profits by using technical indicators and clear decision-making frameworks.

Here’s an outline of the strategy:

Core Principles

- Follow the Trend: Only trade in the direction of a confirmed trend.

- Bullish Trend: When price consistently moves above key levels (e.g., MA50 > MA200) and indicators confirm upward momentum.

- Bearish Trend: When price consistently moves below key levels (e.g., MA50 < MA200) with downward momentum.

- Avoid Ranging Markets: Wait for clear breakouts or trend confirmations to avoid false signals.

- Risk Management:

- Use stop-loss orders to protect against losses.

- Identify and respect key support and resistance levels for entries and exits.

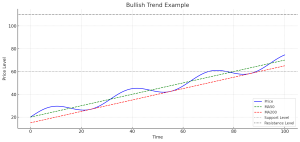

Bullish Trend example

Bullish Trend (First Diagram)

- Price Movement: The price consistently moves upward, staying above key moving averages (MA50 and MA200).

- Indicators:

- The MA50 (green dashed line) is above the MA200 (red dashed line), confirming an upward trend.

- Price forms higher highs and higher lows, staying above key support levels (gray line at 60).

- Key Levels:

- Support Level: Price tends to bounce back when nearing the support level.

- Resistance Level: Price approaches and potentially breaks resistance, indicating strength.

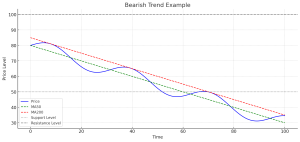

Bearish Trend Example

Bearish Trend (Second Diagram)

- Price Movement: The price consistently moves downward, staying below the key moving averages (MA50 and MA200).

- Indicators:

- The MA50 is below the MA200, confirming a downtrend.

- Price forms lower highs and lower lows, moving away from resistance levels (black line at 100).

- Key Levels:

- Resistance Level: Acts as a ceiling where price retraces during rallies.

- Support Level: Price may briefly bounce but continues downward momentum.

Key Takeaways:

- Bullish Trends: Look for upward price movements above both MA50 and MA200. Wait for price pullbacks to enter near support levels.

- Bearish Trends: Look for downward price movements below both MA50 and MA200. Avoid buying until a trend reversal is clear.

- Avoid Ranging Markets: When MA50 and MA200 lines are close together and price fluctuates without direction, wait for a breakout.

Application:

- Risk Management: Use stop-loss orders just below support levels in bullish trends or above resistance in bearish trends to minimize losses.

- Trade Entries:

- Enter trades when price confirms trends near moving averages and key levels.

- Avoid trades in uncertain or ranging market conditions.

Key Indicators Used

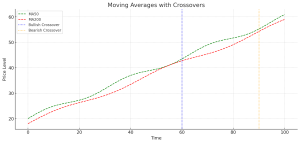

- Moving Averages (MA50 & MA200):

- MA50 crossing above MA200 = bullish crossover.

- MA50 crossing below MA200 = bearish crossover.

Moving Averages (MA50 & MA200): Moving Averages (MA50 & MA200)

- Bullish Crossover: When the MA50 (green line) crosses above the MA200 (red line), it signals a bullish trend. This is marked near time 60.

- Bearish Crossover: When the MA50 crosses below the MA200, it signals a bearish trend. This is marked near time 90.

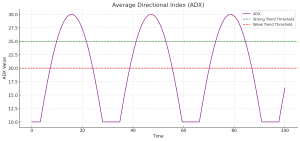

- Average Directional Index (ADX):

- ADX > 25: Strong trend.

- ADX < 20: Weak or ranging market.

-

Average Directional Index (ADX) Average Directional Index (ADX)

- ADX > 25: Indicates a strong trend. The trend can be bullish or bearish, depending on other indicators.

- ADX < 20: Indicates a weak or ranging market. Avoid trading during such periods.

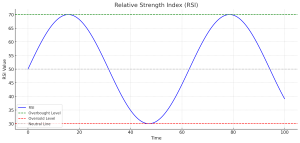

- Relative Strength Index (RSI):

- RSI > 50: Momentum favors buyers (bullish).

- RSI < 50: Momentum favors sellers (bearish).

- Overbought (>70) and oversold (<30) levels indicate potential reversals.

-

Relative Strength Index (RSI) Relative Strength Index (RSI)

- Overbought (>70): Indicates potential reversal or price correction from upward momentum.

- Oversold (<30): Indicates potential reversal or price recovery from downward momentum.

- RSI > 50: Momentum favors buyers (bullish).

- RSI < 50: Momentum favors sellers (bearish).

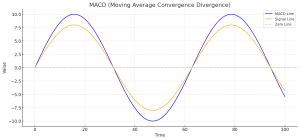

- MACD (Moving Average Convergence Divergence):

- Positive crossover (MACD line > Signal line): Bullish momentum.

- Negative crossover (MACD line < Signal line): Bearish momentum.

-

MACD (Moving Average Convergence Divergence) MACD (Moving Average Convergence Divergence)

- Positive Crossover: The MACD line (blue) crossing above the Signal line (orange) indicates bullish momentum.

- Negative Crossover: The MACD line crossing below the Signal line indicates bearish momentum.

- Zero Line: Acts as a reference point for momentum direction.

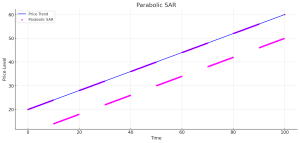

- Parabolic SAR:

- Dots below the price = bullish trend.

- Dots above the price = bearish trend.

- Dots Below the Price: Indicates a bullish trend, where prices are expected to rise.

- Dots Above the Price: Indicates a bearish trend, where prices are expected to fall.

Parabolic SAR Parabolic SAR

- Dots Below the Price: Indicates a bullish trend, where prices are expected to rise.

- Dots Above the Price: Indicates a bearish trend, where prices are expected to fall.

Summary:

These indicators are tools to confirm trends and reversals:

- Use Moving Averages for identifying crossovers.

- Use ADX to measure trend strength.

- Monitor RSI for momentum and reversal signals.

- Use MACD to confirm bullish or bearish momentum.

- Use Parabolic SAR for trend direction and potential stop-loss placement.

- Volume:

- Volume spikes confirm the strength of breakouts or trends.

Process for New Positions

- Analyze Trend:

- Check MA crossovers and ADX for trend direction and strength.

- Confirm with RSI, MACD, and Parabolic SAR.

- Identify Entry Points:

- Breakouts above resistance or below support.

- Trend continuation signals (e.g., price bouncing off moving averages in a strong trend).

- Set Stop-Loss and Take-Profit:

- Place stop-loss below support for long positions or above resistance for short positions.

- Set multiple take-profit levels to scale out gains.

- Wait for Confirmation:

- Avoid impulsive entries. Wait for multiple indicators to align.