How to Identify and Respect Key Support and Resistance Levels

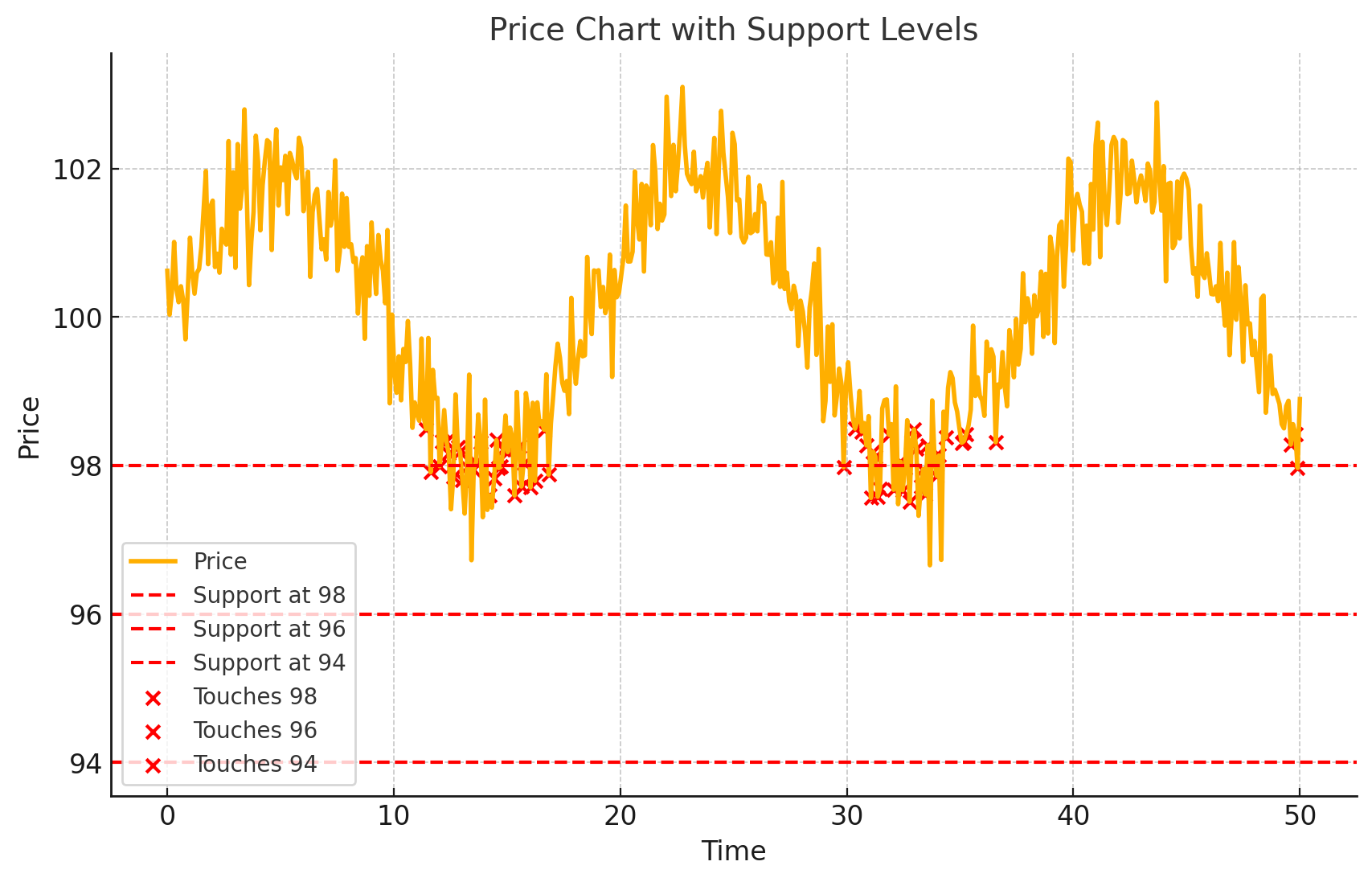

- The red dashed lines represent key support levels at 98, 96, and 94.

- The red dots highlight points where the price touches or approaches these support levels.

Support and Resistance are essential concepts in trading. They represent price levels where the market tends to stop or reverse due to buying or selling pressure. Here’s how to identify and respect them:

Identifying Key Levels

- Look for Previous Highs and Lows:

- Support: A price level where the market bounces upwards repeatedly.

- Resistance: A price level where the market repeatedly fails to go higher.

- Use Historical Data:

- Check the chart for multiple touchpoints at a similar price level. The more times a level has been tested, the stronger it is.

- Use Candlestick Patterns:

- Wicks on candles often indicate where support or resistance levels exist.

- Check for Psychological Levels:

- Round numbers (e.g., $20,000, $25,000) often act as natural support or resistance.

- Indicators for Confirmation:

- Moving Averages: MA50 or MA200 can act as dynamic support or resistance.

- Fibonacci Retracement Levels: Automatically identify potential support and resistance.

Respecting Key Levels

- Wait for Confirmation:

- Don’t blindly trade at a level. Look for a reversal pattern (e.g., bullish engulfing at support) or a breakout with strong volume.

- Set Stop-Loss Orders Wisely:

- Place stop-loss orders slightly below support or above resistance to avoid being stopped out by false breakouts.

- Use Breakout and Retest:

- When the price breaks through resistance, it often retests that level as new support (and vice versa).

- Combine with Other Indicators:

- Use RSI or MACD to confirm if momentum supports a bounce or breakout at the level.

Visual Example

Would you like me to create a chart to show how to identify and trade around support and resistance levels?